In September 2020, Google made significant changes to how Search Term Query reporting displayed results. These changes significantly restricted insight into the search terms that are matched to related to an Advertiser’s bidded keywords. These actions were presented by Google as an effort around protecting consumer privacy, despite no real ability by any advertiser to identify an individual. In a Search Engine Land article written by Ginny Marvin, Google provided the following statement:

“In order to maintain our standards of privacy and strengthen our protections around user data, we have made changes to our Search Terms Report to only include terms that a significant number of users searched for. We’re continuing to invest in new and efficient ways to share insights that enable advertisers to make critical business decisions”

At the time, there was universal concern shared by Advertisers and Agencies that the changes would negatively impact optimization efforts, and this change was not really about privacy. Marvin even noted in her article that “If this really is just the culling of some sensitive queries, fine. But that’s not how this statement reads. There are thousands upon thousands of low-volume queries with zero privacy risk”.

Vincodo couldn’t concur more with Marvin’s statement, especially when it comes to brand trademark terms

What Has Transpired Since Data Restrictions Were Applied?

They say hindsight is 20/20, so let’s take a look at what has transpired four years later and how restrictions on Search Term Query reporting have played out.

As with any functional change by a media provider, there is a goal that is targeted for achievement which is usually related to revenue when that media provider’s stock is publicly traded. The best way to discern the real goals behind what appears to be a subtle change is to look at the series of activities after that change occurs.

The following is a timeline of changes and efforts by Google after the infamous restriction on Search Term Query reporting:

- Responsive Search Ads become the default Ad type option in February 2021

- Enhanced Conversions is launched in May 2021, calling on Advertisers to share personal information on their customers (in a privacy safe format) for improved reporting attribution

- Broad Match Modifiers were deprecated in July 2021 to support Google Automation efforts

- Performance Max was introduced in November 2021 with no Negative Matching ability and no ability to target specific keywords

- Expanded Text Ads were deprecated in July 2022 making Responsive Search Ads the only option for Ad creation

- Smart Shopping campaigns were phased out in July 2022 transitioning them towards Performance Max

With each of the milestone change on Google Ads, Advertisers consistently lost control to powerfully optimize campaigns, thus causing ads to again be served on search queries that previously were shut down by Advertisers.

Were Changes About Privacy Or Increasing SERP Yields?

The real truth behind the aforementioned question lies within how Google is providing details around branded trademark searches. When it comes to Branded trademark terms, exactly what privacy is being protected? How do trademark searches violate someone’s privacy? How many small volume search iterations are actually conducted on trademarks?

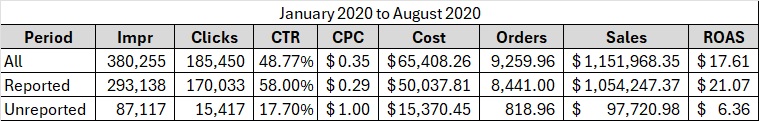

The following data is a sample of how an Advertiser who is extremely frustrated with how their Brand campaign performance was negatively impacted due to Google’s changes. In the eight months in 2020 leading up to Google’s search term reporting deprecations, the Advertiser was achieving a 49% CTR, paying $0.35 for CPCs, achieved a 95% impression share and was obtaining a $17.61 ROAS on its branded trademarks prior to hiring Vincodo.

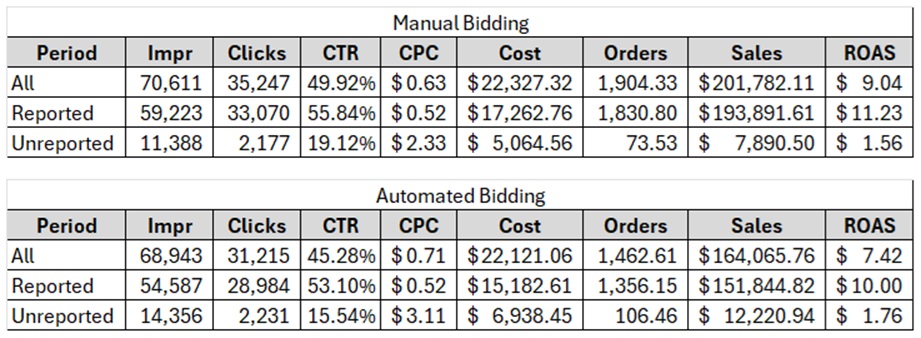

Below is testing we implemented in 2024 due to a drop in Impression Share from 95% to 74% despite Click Share remaining unchanged since 2020 at 94%. Additionally, Auction Insights showed no changes in Competitor Conquesting on the trademarked terms. The testing approach was pre/post testing to determine if moving to Automated Bidding with a Portfolio Bidding strategy could reverse the performance downturn on the Advertisers trademarked brand terms seen under Manual CPC bidding.

The test result evidence displays that the switch to Automated Bidding afforded the Advertiser a 6% increase in Impression Share and a 1% increase in Clickshare. However, the results also indicate that Google served 29% more ads classified as “unreported” in search term reports and Google charged over 33% more for ads classified as “unreported” in search term reports. In short, Automated Bidding aggressively targeted more “unreported” search terms and didn’t move the performance needle on “reported” search terms at all with CPCs holding steady during the test.

Where things get interesting is when you compare results to 2020 prior to Google’s restrictions on Search Term Query reporting and the subsequent functionality changes thereafter. CPCs on “reported” terms have increased 79.3% for this Advertiser while CPCs on “unreported” terms for these brand trademarks have increased 133% on Manual CPC campaigns and 211% on Automated Bidding campaigns. As a frame of reference, inflation has increased by 20.4% during this same time frame. All of this happened while CTRs and Click Share held relatively the same, suggesting no significant change in the competitive landscape.

What Can Advertisers Do To Stem These Concerns?

The answer is unfortunately very little can be done. If this is happening on branded trademarks where we can truly control ad serving the best, imagine what is happening on non-branded search terms. While we should give Google the benefit of the doubt that privacy concerns were a part of their decision-making process to restrict Search Term Query reports, the CPC inflation that is not correlating to Conversion Rate increases is ominous.

The following are some strategies that can offset some of pain:

- Keep aggressively mining negative keywords as much as possible.

- Test whether Manual CPC or Automated Bidding is best option for Branded terms as we have seen varied results with Portfolio Bid Strategies applied

- Make sure that your base Search campaigns stay active and run concurrently with any Performance Max campaigns

There is no best practice strategy that will work for all Advertisers due to the marketing landscape differences each face. But implementing the aforementioned tactics uniquely to your business needs can help limit the negative impact that Advertisers are seeing not only on Branded terms (that were a focus of this analysis), but also the non-brand keywords that are necessary to grow your business.